Inst. Louie Gene G. Marasigan, BSAIS chairperson, and Inst. Dyan...

Read More

Announcements

UST-Alfredo M. Velayo College of Accountancy (2004)

Send us your feedback

By 2030, the UST-Alfredo M. Velayo College of Accountancy envisions itself as a premier institution in accountancy education and research in the Asia-Pacific, producing morally upright world-class accountants and effecting social transformation.

The UST-Alfredo M. Velayo College of Accountancy dedicates itself to:

The UST-Alfredo M. Velayo College of Accountancy embodies the following Thomasian core values:

The UST AMV College of Accountancy (“the college”) believes that the “learners of today are the leaders of tomorrow”. Therefore, teaching and learning are expected to produce competent, compassionate, and committed Thomasian accountants.

Competence: Developing Mental Agility

Learning best happens when learners construct their own knowledge. Facilitators must therefore equip the learners with essential concepts and theories for problem-solving. Furthermore, facilitators (academic staff) should carefully scaffold the problem-solving process through the learner’s application of frameworks, theories, and concepts. Thomasian accountants are expected to select, apply, and reflect on existing theories in analyzing the most pressing accounting issues.

Compassion: Inculcating Our Christian Identity

Tracing its Christian roots, the college believes that all learning is incomplete without its social dimension. Learning in college, therefore, should encompass the ethical and social dimensions of business, finance, and accounting. Furthermore, Thomasian accountants are expected to be reflective of their own decisions, taking into consideration all stakeholders involved.

Commitment: Life-long Learning, Life-long Leading

The college fosters a learning environment where learners are expected to be fully dedicated and committed to their own learning. Rather than giving them answers, leading-learners into a feasible solution enables them to take full ownership of their own learning. As accounting practice constantly evolves, Thomasian accountants are expected to simultaneously learn and lead in their respective fields.

Teaching and learning in the college develop learners into well-rounded professionals where a healthy balance of competence, compassion, and commitment will enable them to lead lives of integrity as professional accountants and nation builders.

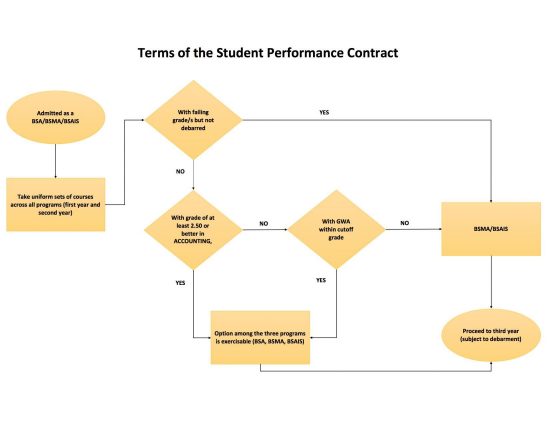

Student Performance Contract (.pdf)

While all programs are anchored on core accounting, business, and general education courses, each program offers a course of study unique and relevant to each accounting specialization.

The BS Accountancy (BSA) program offers a wide array of courses on external financial statements assurance and audit services. BSA graduates are expected to take the licensure examination for certified public accountants administered by the Board of Accountancy (Philippines) and other international accounting certifications (e.g., ACCA).

Meanwhile, the BS Management Accounting (BSMA) program is focused on corporate accounting and controllership. BSMA graduates are expected to take the Certified Management Accountant (CMA) examination administered by the Institute of Management Accountants (USA and Australia), or the Certified Institute of Management Accountants (CIMA).

Finally, the BS Accounting Information System (BSAIS) program is geared towards a career in information systems audit and information technology governance with a foundation on accounting information systems. BSAIS graduates are expected to take the Certified Information Systems Auditor (CISA) examination administered by ISACA (USA), the international professional organization of information technology governance professionals.

With the breadth and depth offered by the specialized and general courses respectively, graduates of the UST AMV College of Accountancy are expected to become lifelong learners and leaders regardless of specialization.

As a rule, the University has a debarment policy applicable to students who incur failures corresponding to 9 units or the equivalent of one-half of their load (for students who did not take the full regular load).

However, freshmen in their first term in the University are exempted from this rule. A student who in his/her first term in the University and who incurs failures corresponding to nine units or more will be allowed to be readmitted in the succeeding term on a probationary basis.

The probationary basis will allow the student to clear all his/her deficiencies until the succeeding special term. Failure to clear the deficiencies and/or incurring additional deficiencies in the second term will exclude the student on probation from admission to the second curriculum year.

Moreover, any student who incurs a failure during the first curriculum years, subject to the debarment policy as stated, cannot anymore proceed to the BS Accountancy Program and may choose between the BSMA or BSAIS.

The debarment policy of the University will apply as discussed above.

An uncleared deficiency pertains to an instance of failure in a course which is still to be removed through retaking and passing the said course.

For example, if in the first term of his/her first year, a student incurs a failure in a three-unit course then the student’s deficiency is three units at the end of the first term.

If in the succeeding (second) term, the same student retakes the same course and still incurs a failure, his/her deficiency becomes six units. As a rule, uncleared deficiencies are counted by instance and not by course.

A student without failure for the first and second years may choose any one of the three programs, including the BSA, if s/he has a grade of 2.50 or better in all accounting, finance, law, and taxation courses. All other students who did not incur failures but did not meet the 2.50 grade will be ranked based on grades’ weighted average (GWA) and may be considered for the BSA program, subject to availability of slots.

Yes, the student may be retained in the BSA program provided s/he did not incur failures in any of the courses. S/he may also shift to the BSMA or BSAIS programs.

Yes, provided that all classification requirements are met. However, courses in the first and second years across the three programs are common. It is more efficient if the student will wait for the classification process (at the end of the second year) if s/he considers shifting to another program.

Yes, the debarment policy will still apply to all students across all programs. The debarment policy of the University does not allow his/her admission during the subsequent term when the accumulated uncleared deficiency is at least 9 units. Fourth year students, however, are not anymore subject to debarment. For this purpose, fourth year students are those who have successfully completed all the courses in the three curriculum years of the program.

Yes, the debarment policy will still apply to all students across the program, except for fourth-year students. Also for this purpose, fourth year students are those who have successfully completed all the courses in the three curriculum years of the program(s).

Yes, this will be considered as a second-degree application covered by the student handbook (PPS No. 1009a). Furthermore, the 2.50 grade requirement during the first two curriculum years, among others shall still apply.

Inst. Louie Gene G. Marasigan, BSAIS chairperson, and Inst. Dyan...

Read MoreThe University of Santo Tomas produced 94 new Thomasian certified...

Read More

(1st Century AD), husband of the Blessed Virgin Mary

Patron of the UST-AMV College of Accountancy

Feast Day: March 19

St. Joseph, the spouse of the Blessed Virgin Mary and the foster-father of Jesus, was probably born in Bethlehem and probably died in Nazareth. In the plan of salvation, God assigned to Joseph, “the just man” (cf. Mt 1:19), and spouse of the Virgin Mary (cf. ibid; Lk 1:27), a particularly important mission: legally to insert Jesus Christ into the line of David from whom, according to the prophets, the Messiah would be born, and to act as his father and guardian.

In virtue of this mission, God revealed to Joseph that Jesus had been conceived by the Holy Spirit; (cf. Mt 1:20-21); he witnessed the birth of Christ in Bethlehem (cf. Lk 2:6-7), the adoration of the shepherds (cf. Lk 2:15-16), the adoration of the Magi (cf. Mt 2:11); he fulfilled his mission religiously with regard to the rearing of Christ, having had him circumcised according to the discipline of the Covenant of Abraham (Lk 2:21) and in giving him the name of Jesus (Mt 1:21); in accordance with the Law of the Lord, he presented Christ in the Temple and made the offering prescribed for the poor (cf. Lk 2:22-24; Ex 13:2,12-13), and listened in wonder to the prophecy of Simeon (cf. Lk 2:25-33); he protected the Mother of Christ and her Son from the persecution of Herod by taking them to Egypt (cf. Mt 2:13-23); together with Mary and Jesus, he went every year to Jerusalem for the Passover, and was distraught at having lost the twelve year old Jesus in the Temple (Lk 2:43-50); he lived in Nazareth and exercised paternal authority over Jesus who was submissive to him (Lk 2:51); he instructed Jesus in the law and in the craft of carpentry.

St. Joseph was the provider of the holy family; he was accountable for Jesus as His foster-father, and the Blessed Virgin Mary as her husband. He died before the beginning of Christ’s public life. His was the most beautiful death that one could have, in the arms of Jesus and Mary. Humbly and unknown, he passed his years at Nazareth in silence. He is the patron of the Universal Church. He is the patron of the dying. He is the patron of the UST-AMV College of Accountancy.

Sources:

Prof. Patricia M. Empleo, CPA, PhD

Dean

Rev. Fr. Franklin F. Beltran, O.P., PhD

Regent

Asst. Prof. Fermin Antonio D.R. Yabut, CPA, PhD

College Secretary

Prof. Patricia M. Empleo, CPA, PhD

Chair (Ex-Officio)

Rev. Fr. Franklin F. Beltran, O.P., PhD

Member (Ex-Officio)

Asst. Prof. Christopher I. German, CPA, MBA, MSPA

Member

Inst. Luis M. Chua, CPA, MS

Member

Asst. Prof. Fermin Antonio D.R. Yabut, CPA, PhD

Secretary (Ex-Officio)

Asst. Prof. Ryan N. Alejo, CPA, DBA

Doctor of Business Administration

Asst. Prof. Alfred Lindon F. Berbano, CPA, MBA

Master of Business Administration

Inst. Ivan Yannick S. Bagayao, CPA, MBA, Ll. B.

Bachelor of Laws

Inst. Antonio B. Burgos, CPA, MBA

Master of Business Administration

Inst. Antonio Eriberto C. Cabug, CPA, MBA

Master of Business Administration

Asst. Prof. Francisco M. Caliwan Jr., CPA, MBA, MSPA

Master of Business Administration

Master of Science in Professional Accounting

Inst. Luis M. Chua, CPA, MS

Master of Science in Computational Finance

Inst. Albert D. Cruz, CPA, MSPA

Master of Science in Professional Accounting

Asst. Prof. Richmond V. Cruz, CPA, MBA

Master of Business Administration

Asst. Prof. Michael M. Dalimot, CPA, DBA

Doctor of Business Administration

Assoc. Prof. Antonio J. Dayag, CPA, PhD

Doctor of Philosophy, major in Commerce

Prof. Patricia M. Empleo, CPA, PhD

Doctor of Philosophy, major in Business Management

Inst. Dyan Nicole M. Francisco, CPA, MBA

Master of Business Administration

Inst. Alfonso G. Garcera, CPA, MBA

Master in Business Administration

Asst. Prof. Earl Jimson R. Garcia, CPA, MBA

Master in Business Administration

Inst. Daryl Angelo M. Geraldo, CPA, LPT, MBA

Master in Business Administration

Asst. Prof. Christopher I. German, CPA, MBA, MSPA

Master in Business Administration

Master of Science in Professional Accounting

Atty. Abigail L. Ibañez, CPA, MBA

Master in Business Administration

Asst. Prof. Apollo D.C. Layug, CPA, MBA

Master in Business Administration

Inst. Tristan L. Lopez, Ll. B.

Bachelor of Laws

Inst. Gorgonio D. Macariola, CPA, MBA

Master in Business Administration

Inst. Louie Gene G. Marasigan, CPA, MBA

Master in Business Administration

Asst. Prof. Melba C. Matula, CPA, MBA

Master in Business Administration

Inst. Gerber G. Mendoza, CPA, MBA

Master in Business Administration

Asst. Prof. Fe R. Ochotorena, CPA, LPT, DBA

Doctor in Business Administration

Inst. Clark Joed C. Otucan, CPA, MBA

Master in Business Administration

Asst. Prof. Eliseo R. Panganiban, III, CPA, MSPA

Master of Science in Professional Accounting

Inst. Almario G. Parco, Jr., CPA, MBA

Master in Business Administration

Inst. Ian Paulo N. Punsalan, MM

Master of Management

Asst. Prof. Anna Marie T. Querrer, CPA, JD

Juris Doctor

Inst. Clifford V. Ramos, CAP, MBA, Ll. B.

Master in Business Administration

Bachelor of Laws

Asst. Prof. Ronald A. Ricablanca, CPA, MBA, Ll. B.

Master in Business Administration

Bachelor of Laws

Inst. Alan Jeffrey T. Santos, CPA, MSPA

Master of Science in Professional Accounting

Asst. Prof. Enrico D. Tabag, CPA, MBA

Master in Business Administration

Asst. Prof. Fernando I. Talion, CPA, DBA

Doctor of Business Administration

Asst. Prof. Ferdinand L. Timbang, CPA, DBA

Doctor of Business Administration

Asst. Prof. Francisco H. Villamin, Jr., CPA, DBA

Doctor of Business Administration

Asst. Prof. Fermin Antonio D.R. Yabut, CPA, PhD

Doctor of Philosophy in Leadership Studies

Inst. Kenneth Lloyd G. dela Cruz, Ll. B.

Bachelor of Laws

Inst. James Christopher D. Domingo, CPA, MBA, Ll. B.

Master in Business Administration

Bachelor of Laws

Asst. Prof. Almanzor P. Sarip Macmod, CPA, Ll. B.

Bachelor of Laws

Assoc. Prof. Mary Jane A. Castilla, PhD

Doctor of Philosophy in Mathematics Education

Inst. Gerardo M. Castro, MBA

Master in Business Administration

Assoc. Prof. Ginavee F. Dapula, PhD

Doctor of Philosophy, major in Commerce

Asst. Prof. Cecilia D. Flores, MA

Master of Arts in Economics

Inst. Luisito S. Macapagal, LPT, MA

Master of Arts in Mathematics

Asst. Prof. Arnold M. Petalver, PhD

Doctor of Mathematics Education

Asst. Prof. Edgar Allan M. Uy, PhD

Doctor of Philosophy, major in Economics

Ms. Maria Agnes B. Bonifacio, MA, RGC

mbbonifacio@ust.edu.ph

Master of Arts in Education, major in Guidance and Counseling

Ms. Gilda G. Sarmiento, MA, RGC

ggsarmiento@ust.edu.ph

Master of Arts, Major in Guidance and Counseling

Ms. Anna Carmela C. Santos

Office Clerk

Mr. Robert Jay B. Mancio

Laboratory Technician

In April 2025, Mr. Alfonso G. Garcera was awarded the FAMAS Prestige Award for Outstanding Accountant of the Year.

Ms. Alexia Nichole R. Guadalupe and Mr. Andrew C. Halili placed 8th while Ms. Alexandra B. Osias placed 9th in the December 2024 licensure examination for certified public accountants.

In November 2024, Asst. Prof. Francisco M. Caliwan, Jr. was awarded the PICPA Outstanding Certified Public Accountant in Education while Assoc. Prof. Antonio J. Dayag, Ph.D. was awarded the PICPA Special Achievement for Professional Development.

Mr. Antonio Angelito J. Ga and Ms. Ma. Kristine Jaira D. Ramos were awarded the Second and Third Highest Scorers, respectively, of the Certified Information Systems Auditor Examination in the July to December 20204 window.

Mr. James Edver O. Mercado, BSAIS Class of 2024 was awarded the Nationwide Highest Examination Scorer of the Certified Information Systems Auditor Examination in the January to June 2024 window.

Mr. Mark Johnrei J. Gandia and Mr. Joseph Angelo B. Ogrimen placed 4th and 8th, respectively, in the September/October 2023 licensure examination for certified public accountants.

Ms. Shannen C. Jagwani received the Priscilla S. Payne Outstanding Student Performance Award for the May/June 2023 exam window of the CMA examination. The award is given to a student who has received the highest CMA exam score across the globe.

In May 2023, the BS Accountancy program received the ASEAN University Network Quality Assurance re-certification.

In July 2023, Asst. Prof. Francisco M. Caliwan Jr. was elected as the president of the National Association of CPAs in Education.

Mr. Francis Matthew N. Obligacion topped the October 2022 CPA Licensure Examination. Joining Mr. Obligacion was Mr. Marion Jasper T. Tagle (5th).

Ms. Jhoone Cyrelle D. Nacario topped the May 2022 CPA Licensure Examination. Joining Ms. Nacario were Ms. Charlene Mae N. Perez (3rd), Gerimee R. Mappatao (8th), and August Joshua T. Dela Cruz (10th).

Mr. Vincent E. Egalloy was awarded the ICMA Silver Medal Award for garnering the second highest worldwide score in the May/June 2022 Certified Management Accountants Examination.

Prof. Particia M. Empleo, Ph.D. was awarded as PICPA’s Outstanding Certified Public Accountant in Education. Mr. Fermin Antonio Del D.R. Yabut was awarded as PICPA’s Young Achiever in Education.

In May 2021, Prof. Patricia M. Empleo, Ph.D. was conferred the Pillar of Accounting Education award by the National Association of Certified Public Accountants in Education (NACPAE).

Mr. Angel John F. Geronimo received the ICMA Student Certificate of Distinguished Performance award in the September/October 2020 CMA Examination.

Mr. Justine Louie B. Santiago topped the October 2018 CPA Licensure Examination. Joining Mr. Santiago were Mr. Marc Angelo G. Santos (5th), Mr. Bill Julius L. Ocampo (6th), Ms. Alyssa Nicole D. Rosario (9th), Ms. Lovel A. Dulay (10th), and Mr. Jhudge P. Salaya (10th).

Mr. Michael John M. Cortes and Ms. Jo-Anne R. Etin received the ICMA Gold and Silver Medal Awards, respectively, in the September/October 2019 CMA Examination. Meanwhile, Ms. Cherica Joy A. Angeles, Mr. Bill Julius I. Ocampo and Mr. Justine Louie B. Santiago received the ICMA Student Certificate of Distinguished Performance award.

In November 2019, the College hosted the 10th ASEAN Accounting Education Workgroup Meeting with the theme “AAEW@10: Working Together for a Learned Global Accounting Profession”.

In February 2018, Prof. Patricia M. Empleo, Ph.D. was inducted to the Global Accounting Hall of Fame by the Institute of Certified Management Accountants.

In May 2018, the College established the UST Accounting Center.

In August 2018, the College offered another program in the accountancy umbrella, the BS Accounting Information System.

Ms. Lahaira Amy C. Reyes topped the October 2018 CPA Licensure Examination. Joining Ms. Reyes were Mr. Marc Angelo S. Sanchez (4th), Ms. Charissa Mae S. Espinola (5th), Ms. Kathleen Mae T. Puno (5th), and Mr. James Andrew H. Licaros (10th).

Mr. Marc Angelo S. Sanchez received the ICMA Priscilla S. Payne Outstanding Student Performance Award for obtaining the highest score among student-examinees across the globe in the September/October 2018 CMA Examination. He was joined by Ms. Francyne Jean M. Corpuz, Ms. Charissa Mae S. Espinola, Ms. Ma. Louella R. Pantorgo, and Ms. Lahaira Amy C. Reyes who all received the ICMA Student Certificate of Distinguished Performance award.

In November 2018, Mr. Francisco M. Caliwan, Jr., was conferred the Young Achiever Award in Education by the Philippine Institute of Certified Public Accountants (PICPA).

The College expanded its wings by demonstrating its supremacy in the Certified Management Accountant program, a global certification of management accountants. In February 2017 CMA Examination, Mr. Janfher V. Sobinsky received the ICMA Student Certificate of Distinguished Performance award.

In August 2017, the BS Accountancy program received the ASEAN University Network Quality Assurance certification.

The University was hailed as the 3rd top performing school in the October 2017 CPA Licensure Examination with 91.99% passing rate, with six topnotchers namely: Mr. Alfonso Solomon R. Magno topped the October 2017 CPA Licensure Examination. Joining Mr. Magno were Mr. Ray Jay M. Dizon (4th), Mr. Alvin Thomas M. Endaya (7th), Ms. Maria Isabel C. Marfil (9th), Mr. Marc Euvil D. Villaverde (9th), Ms. Louize Allain T. Areño (10th), and Ms. Christine Mae B. De Leon (10th).

In December 2017, the University of Santo Tomas was accepted into the membership of the ASEAN Accounting Education Workgroup.

On April 13, 2016, the College established the Accountancy Continuing Professional Development (CPD) Center, a Professional Regulator Board of Accountancy (PRBOA) -accredited CPD provider.

The University was hailed as the 2nd top performing school in the May 2016 CPA Licensure Examination with 90.32% passing rate.

The University was hailed as the 2nd top performing school in the October 2016 CPA Licensure Examination with 90.72% passing rate, with five topnotchers namely: Ms. Patricia Mae D. Muñoz (3rd), Mr. Ariel Joseph B. Nipas (3rd), Ms. Mikie Menelli T. So (4th), Mr. John Henry G. Pantoja (6th), and Marlon Chris M. Malicsi (10th).

The University was hailed as the 2nd top performing school in the October 2015 CPA Licensure Examination with 95.29% passing rate, with two topnotchers namely: Ms. May Anne R. Reyes (7th) and Ms. Ma. Rosa Mia R. Reyes (8th).

The University was hailed as the 4th top performing school in the October 2013 CPA Licensure Examination with 89.65% passing rate, with two topnotchers namely: Ms. Loraine J. Santos (2nd) and Mr. Jayrod E. Natnat (10th).

Ms. Kathrine Rose C. Catindig placed 2nd in the May 2012 CPA Licensure Examination.

The University was hailed as the 3rd top performing school in the October 2012 CPA Licensure Examination with 93.09% passing rate.

The College made history with two Thomasians landing the first place in the October 2012 CPA Licensure Examination, heralding UST as the first University to achieve such a record in the history of Philippine CPA Licensure Examination. The topnotchers are Mr. Bren S. Cruz and Ms. Celaica C. Vibar (1st place), Mr. Kervin C. Cortes (9th), Mr. Tristan John T. De Guzman (10th) and Ms. Eloisa P. Galang (10th).

The University was hailed as the 2nd top performing school in the October 2011 CPA Licensure Examination with 88.86% passing rate, with four topnotchers namely: Ms. Nathalie C. Lao (9th), Ms. Janine G. Sy (10th), Ms. Jenine D. Tan (10th), and Ms. Eunice Faye C. Valera (10th).

Ms. Ellen Joy A. Garcia placed 4th in the May 2010 CPA Licensure Examination.

The University was hailed as the 2nd top performing school in the October 2010 CPA Licensure Examination with 92.23% passing rate, with three topnotchers namely: Mr. Lean Jeff M. Magsombol (4th), Ms. Patricia Maita M. Dimayuga (9th), and Mr. Stephen Ray C. Taguba (10th).

The University was hailed as the 2nd top performing school in the October 2009 CPA Licensure Examination with 87.78% passing rate, with six topnotchers namely: Francis Angel L. Reyes (4th), Cris Leo M. Villanueva (7th), Miken F. Padilla (8th), Alissa Star E. Reyes (8th), Gibson T. Tan (8th), and Jerlyn C. Dela Cruz (9th).

In June 2007, the College started offering the Bachelor of Science in Management Accounting program.

The University was hailed as the top performing school in the October 2007 CPA Licensure Examination with 85.65% passing rate. Leading the batch of passers was Mr. Genghis O. Grospe in 6th place.

Ms. Frances Ann D. Amog placed 6th in the May 2006 CPA Licensure Examination.

Mr. Smith C. Lim placed 4th in the October 2006 CPA Licensure Examination. He is joined by Ms. Diana Rose U. Cue and Ms. Jessamyn U. Domingo who both placed 7th.

Ms. Jhoanna Go topped the May 2005 CPA Licensure Examination.

The University was hailed as the top performing school in the October 2005 CPA Licensure Examination with 85.71% passing rate, with four topnotchers namely: Shayne B. Laparan (5th), Alan L. Roque (6th), Grace E. Macabata (9th), and Manny John M. Tan (9th).

On November 10, 2004, the University of Santo Tomas, upon the recommendation of and in coordination with the UST College of Commerce Alumni Foundation, Inc. (COCAFI), established the UST-Alfredo M. Velayo College of Accountancy (UST-AMV CoA). The College is the first and, so far, the only degree-granting unit of the University named after a private individual, an unprecedented event in the history of the oldest university in the Philippines.

The University of Santo Tomas is one of the leading private research universities in the Philippines and is consistently ranked among the top 1000 universities in the whole world. With academic degrees and research thrusts in the natural, health, applied, social, and sacred sciences, as well as business and management, the University continuously strives to make a positive impact on the society.

Visit Us:

Espana Blvd., Sampaloc, Manila, Philippines 1008

© Copyright 2019. University of Santo Tomas. All Rights reserved. | Powered by Communications Bureau