Announcements

The program Bachelor of Science in Accountancy (BSA) exceeds the minimum requirements under CMO Number 27 s. 2017 Revised Policies, Standards and Guidelines for the Bachelor of Science in Accountancy and complies with the most recent competency framework of the International Education Standards (IES) issued by the International Federation of Accountants (IFAC). The graduates of this program shall be categorized as belonging to Level 6 of the Philippine Qualifications Framework and ASEAN Qualifications Framework and qualify to take the CPA Licensure Examination given by the Professional Regulations Commission and assessments leading to certifications in Accountancy certifications by global professional Accountancy and Finance organizations. In response to the global call for a more sustainable and inclusive development, the program is also aligned with the United Nations Sustainable Development Goals and the Philippine Development Plan.

As described in the CMO, Accounting professionals are involved in providing assurance and audit services for statutory financial reporting, tax-related services, management advisory services partnering in management decision-making, devising planning and performance and control systems, and providing expertise in financial reporting and control to assist various stakeholders in making decisions.

The goal of the BSA Program is to produce competent and ethical public accounting professionals who possess the knowledge, skills, and attitudes that will enable them to continue to learn and adapt to change throughout their professional lives.

The Bachelor of Science in Accountancy of the UST-AMV College of Accountancy aims to develop in each student a holistic personality that will prepare him/her for the pursuit of a rewarding career in the practice of accountancy and harmonious family life.

The graduates of the UST-AMV College of Accountancy must exemplify the following attributes three to five years after graduation (Anchored on the ThoGAs or Thomasian Graduate Attributes).

Servant Leadership: Graduates must be able to lead teams, organizations, and communities in the field of public financial accounting, auditing, management accounting, finance, and business, as manifested in their compassionate, humane, and fair treatment of all stakeholders as they live an integrated personal, family, and professional life.

Effective Collaborator and Communicator: Graduates must be able to engage in collaborative decision-making in the field of financial accounting, auditing, management accounting, finance, and business through the competent application of appropriate communication strategies and building consensus among stakeholders.

Analytical and Creative Thinker: Graduates must be able to solve both technical and adaptive problems in the field of financial accounting, auditing, management accounting, finance, and business through the application of appropriate accounting tools and techniques and digital technology in bringing about sustainable value creation.

Lifelong Learner: Graduates must be able to commit to their continuing professional development in the field of financial accounting, auditing, management accounting, finance, and business through formal, non-formal, and informal learning modes with the aim of improving their competencies for the service of all concerned stakeholders.

To be able to achieve this, the BS Accountancy program aims to

Application Period: August to November of each year

Release of Results: Second Quarter of the following year

Go to THIS PAGE and look for the “College of Accountancy” tab for the tuition fees.

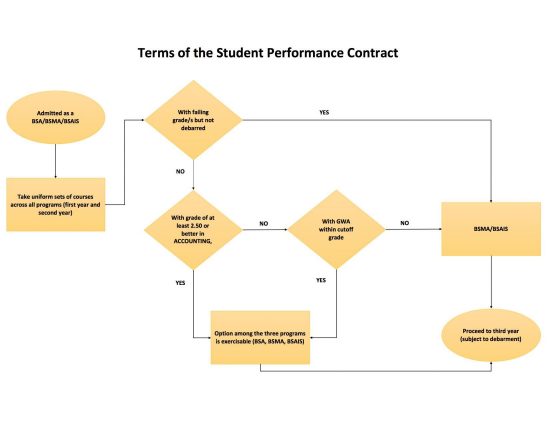

Student Performance Contract (.pdf)

The Bachelor of Science in Accountancy aims to prepare its learners to pursue rewarding careers in challenging and evolving work environments.

The University of Santo Tomas provides student services that cater to the academic, spiritual, and wellness concerns of students. These support units are found in the different parts of the campus and can be accessed by Thomasians. When the University shifted to distance learning, the services also transitioned to online services to continue addressing the needs of Thomasians.

Effectivity: A.Y. 2023-2024

This curriculum may have some changes upon the availability of new guidelines.

Year | First Term (August – December) | Second Term (January – May) | Special Term (June – July) |

1 | / | / | none |

2 | / | / | none |

3 | / | / | none |

4 | / | / | none |

UST | CHEd | |

General Education | 39 | 36 |

Theology | 12 | – |

NSTP | 6 | 6 |

PE | 8 | 8 |

Common Business and Management Courses | 6 | 6 |

Core Accounting Education Courses | 85 | 81 |

Cognates / Major / Professional Courses | 63 | 36 |

TOTAL | 219 | 173 |

First Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

CA 5101 | Financial Accounting and Reporting | 6 | 0 | 6 | |

CA 5102 | Managerial Economics | 3 | 0 | 3 | |

CA 5103 | Management Science | 3 | 0 | 3 | |

GE ELECI | Elective I | 3 | 0 | 3 | |

MATH_MW | Mathematics in the Modern World | 3 | 0 | 3 | |

NSTP 1 | National Service Training Program 1 | 0 | 3 | 3 | |

PATH-FIT 1 | Physical Activities Towards Health and Fitness 1: | 2 | 0 | 2 | |

READ_PH | Readings in Philippine History | 3 | 0 | 3 | |

THY 1 | Christian Vision of the Human Person | 3 | 0 | 3 | |

UND_SELF | Understanding the Self | 3 | 0 | 3 | |

TOTAL | 29 | 3 | 32 |

Second Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

CA 5104 | Operations Management and Total Quality Management | 3 | 0 | 3 | CA 5103 |

CA 5105 | Intermediate Accounting 1 | 3 | 0 | 3 | CA 5101 |

CA 5106 | Conceptual Framework and Accounting Standards | 3 | 0 | 3 | CA 5101 |

CA 5107 | Cost Accounting and Control | 3 | 0 | 3 | CA 5101 |

CA 5108 | Economic Development | 3 | 0 | 3 | |

GE ELECII | Elective II | 3 | 0 | 3 | |

NSTP 2 | National Service Training Program 2 | 0 | 3 | 3 | NSTP 1 |

PATH-FIT 2 | Physical Activities Towards Health and Fitness 2: | 2 | 0 | 2 | |

PURPCOM | Purposive Communication | 3 | 0 | 3 | |

STS | Science, Technology, and Society | 3 | 0 | 3 | |

THY 2 | Christian Vision of Marriage and Family | 3 | 0 | 3 | THY 1 |

TOTAL | 29 | 3 | 32 |

First Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

ART_APP | Art Appreciation | 3 | 0 | 3 | |

CA 51010 | Intermediate Accounting 2 | 3 | 0 | 3 | CA 5105 |

CA 51011 | Law on Obligations and Contracts | 3 | 0 | 3 | |

CA 51012 | Financial Management | 3 | 0 | 3 | CA 5106 |

CA 51013 | Information Technology Applications Tools in Business | 3 | 0 | 3 | CA 5101, CA 5103 |

CA 51014 | Strategic Cost Management | 3 | 0 | 3 | CA 5107 |

ETHICS | Ethics | 3 | 0 | 3 | |

FIL | Panimulang Pagsasalin | 3 | 0 | 3 | |

PATH-FIT 3 | Physical Activities Towards Health and Fitness in Dance and Recreational Activities | 2 | 0 | 2 | PATH-FIT 1, |

THY 3 | Christian Vision of the Church in the Society | 3 | 0 | 3 | THY 1, THY 2 |

TOTAL | 29 | 0 | 29 |

Second Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

CA 5109 | Income Taxation | 3 | 0 | 3 | CA 5101 |

CA 51016 | Intermediate Accounting 3 | 3 | 0 | 3 | CA 51010 |

CA 51017 | Business Laws and Regulations | 3 | 0 | 3 | CA 51011 |

CA 51018 | Statistical Analysis with Software Application | 3 | 0 | 3 | CA 51013 |

CA 51019 | Accounting Information System | 3 | 1 | 4 | CA 51013 |

CONTEM_W | The Contemporary World | 3 | 0 | 3 | |

GE ELECIII | Elective III | 3 | 0 | 3 | |

LIWORIZ | Life and Works of Rizal | 3 | 0 | 3 | |

PATH-FIT 4 | Physical Activities Towards Health and Fitness in Sports, | 2 | 0 | 2 | PATH-FIT 1, |

THY 4 | Living the Christian Vision in the Contemporary World | 3 | 0 | 3 | THY 1, THY 2, THY 3 |

TOTAL | 29 | 1 | 30 |

First Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

ACC 5111 | Auditing and Assurance Principles | 3 | 0 | 3 | CA 51016 |

ACC 5112 | Auditing and Assurance Principles: Concepts and Applications 1 | 3 | 0 | 3 | CA 51016 |

CA 51015 | Business Tax | 3 | 0 | 3 | CA 5109 |

CA 51020 | International Business and Trade | 3 | 0 | 3 | CA 5108 |

CA 51021 | Financial Markets | 3 | 0 | 3 | CA 51012 |

CA 51022 | Governance, Business Ethics, Risk Management, and Internal Control | 3 | 0 | 3 | CA 51011, ETHICS, THY 4 |

CA 51023 | Accounting Research Methods | 3 | 0 | 3 | CA 51016, CA 51018 |

CA 51024 | Accounting for Business Combinations | 3 | 0 | 3 | CA 51016, CA 5106 |

CA 51025 | Regulatory Framework and Legal Issues in Business | 3 | 0 | 3 | CA 51011 |

CA 51030 | Intermediate Accounting 4 | 3 | 0 | 3 | CA 51016 |

TOTAL | 30 | 0 | 30 |

Second Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

ACC 5113 | Accounting Internship | 0 | 6 | 6 | ACC 5111, ACC 5112 |

ACC 5114 | Accounting Research | 3 | 0 | 3 | ACC 5111, CA 51023 |

ACC 5115 | Intermediate Financial Reporting | 3 | 0 | 3 | CA 51030 |

TOTAL | 6 | 6 | 12 |

First Term

Abbreviation |

Description |

Lec. Hrs. |

Lab. Hrs. |

Units |

Pre-Requisites |

ACC 5116 |

Accounting for Special Transactions |

3 |

0 |

3 |

CA 51015 |

ACC 5117 |

Auditing and Assurance: Concepts and Applications 2 |

3 |

0 |

3 |

ACC 5111, ACC 5112 |

ACC 5118 |

Auditing and Assurance: Specialized Industries |

3 |

0 |

3 |

ACC 5111, ACC 5112 |

ACC 5119 |

Auditing in a CIS Environment |

3 |

0 |

3 |

ACC 5111, CA 51019 |

CA 51026 |

Strategic Management |

3 |

0 |

3 |

CA 51022 |

CA 51027 |

Accounting for Government and Non-Profit Organizations |

3 |

0 |

3 |

CA 51030 |

CA 51028 |

Strategic Business Analysis |

3 |

0 |

3 |

CA 51022 |

ELE 1 |

Professional Elective 1 |

3 |

0 |

3 |

CA 51016, CA 51017, CA 51018, CA 51019 |

ELE 2 |

Professional Elective 2 |

3 |

0 |

3 |

CA 51016, CA 51017, CA 51018, CA 51019 |

ELE 3 |

Professional Elective 3 |

3 |

0 |

3 |

CA 51016, CA 51017, CA 51018, CA 51019 |

TOTAL |

30 |

0 |

30 |

Second Term

Abbreviation |

Description |

Lec. Hrs. |

Lab. Hrs. |

Units |

Pre-Requisites |

ACC 51110 |

Integrated Review in Financial Accounting and Reporting |

6 |

0 |

6 |

ACC 5115 |

ACC 51111 |

Integrated Review in Special Topics Financial Accounting and Reporting |

3 |

0 |

3 |

ACC 5116, CA 51024, CA 51027 |

ACC 51112 |

Integrated Review in Strategic Cost and Financial Management |

3 |

0 |

3 |

CA 51014, CA 51021 |

ACC 51113 |

Integrated Review in Auditing and Assurance |

3 |

0 |

3 |

ACC 5117, ACC 5118, ACC 5119 |

ACC 51114 |

Integrated Review in Business Law and Regulatory Framework |

3 |

0 |

3 |

CA 51017, CA 51025 |

ACC 51115 |

Integrated Review in Taxation |

3 |

0 |

3 |

CA 51015 |

ELE 4 |

Professional Elective 4 |

3 |

0 |

3 |

CA 51016, CA 51017, CA 51018, CA 51019 |

TOTAL |

24 |

0 |

24 |

Effectivity: A.Y. 2021-2022

This curriculum may have some changes upon the availability of new guidelines.

Year | First Term (August – December) | Second Term (January – May) | Special Term (June – July) |

1 | / | / | none |

2 | / | / | none |

3 | / | / | none |

4 | / | / | none |

UST | CHEd | |

General Education | 39 | 36 |

Theology | 12 | – |

NSTP | 6 | 6 |

PE | 8 | 8 |

Common Business and Management Courses | 6 | 6 |

Core Accounting Education Courses | 85 | 81 |

Cognates / Major / Professional Courses | 63 | 36 |

TOTAL | 219 | 173 |

First Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

CA 5101 | Financial Accounting and Reporting | 6 | 0 | 6 | |

CA 5102 | Managerial Economics | 3 | 0 | 3 | |

CA 5103 | Management Science | 3 | 0 | 3 | |

GE ELECI | Elective I | 3 | 0 | 3 | |

MATH_MW | Mathematics in the Modern World | 3 | 0 | 3 | |

NSTP 1 | National Service Training Program 1 | 0 | 3 | 3 | |

PATH-FIT | Physical Activities Towards Health and Fitness in Dance | 2 | 0 | 2 | |

READ_PH | Readings in Philippine History | 3 | 0 | 3 | |

THY 1 | Christian Vision of the Human Person | 3 | 0 | 3 | |

UND_SELF | Understanding the Self | 3 | 0 | 3 | |

TOTAL | 29 | 3 | 32 |

Second Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

CA 5104 | Operations Management and Total Quality Management | 3 | 0 | 3 | CA 5103 |

CA 5105 | Intermediate Accounting 1 | 3 | 0 | 3 | CA 5101 |

CA 5106 | Conceptual Framework and Accounting Standards | 3 | 0 | 3 | CA 5101 |

CA 5107 | Cost Accounting and Control | 3 | 0 | 3 | CA 5101 |

CA 5108 | Economic Development | 3 | 0 | 3 | |

GE ELECII | Elective II | 3 | 0 | 3 | |

NSTP 2 | National Service Training Program 2 | 0 | 3 | 3 | NSTP 1 |

PATH-FIT | Human Enhancement | 2 | 0 | 2 | |

PURPCOM | Purposive Communication | 3 | 0 | 3 | |

STS | Science, Technology, and Society | 3 | 0 | 3 | |

THY 2 | Christian Vision of Marriage and Family | 3 | 0 | 3 | THY 1 |

TOTAL | 29 | 3 | 32 |

First Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

ART_APP | Art Appreciation | 3 | 0 | 3 | |

CA 51010 | Intermediate Accounting 2 | 3 | 0 | 3 | CA 5105 |

CA 51011 | Law on Obligations and Contracts | 3 | 0 | 3 | |

CA 51012 | Financial Management | 3 | 0 | 3 | CA 5106 |

CA 51013 | Information Technology Applications Tools in Business | 3 | 0 | 3 | CA 5101, CA 5103 |

CA 51014 | Strategic Cost Management | 3 | 0 | 3 | CA 5107 |

ETHICS | Ethics | 3 | 0 | 3 | |

FIL | Panimulang Pagsasalin | 3 | 0 | 3 | |

PATH-FIT | Physical Activities Towards Health and Fitness in Sports | 2 | 0 | 2 | |

THY 3 | Christian Vision of the Church in the Society | 3 | 0 | 3 | THY 1, THY 2 |

TOTAL | 29 | 0 | 29 |

Second Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

CA 5109 | Income Taxation | 3 | 0 | 3 | CA 5101 |

CA 51016 | Intermediate Accounting 3 | 3 | 0 | 3 | CA 51010 |

CA 51017 | Business Laws and Regulations | 3 | 0 | 3 | CA 51011 |

CA 51018 | Statistical Analysis with Software Application | 3 | 0 | 3 | CA 51013 |

CA 51019 | Accounting Information System | 3 | 1 | 4 | CA 51013 |

CONTEM_W | The Contemporary World | 3 | 0 | 3 | |

GE ELECIII | Elective III | 3 | 0 | 3 | |

LIWORIZ | Life and Works of Rizal | 3 | 0 | 3 | |

PATH-FIT | Fitness Exercises for Specific Sports | 2 | 0 | 2 | |

THY 4 | Living the Christian Vision in the Contemporary World | 3 | 0 | 3 | THY 1, THY 2, THY 3 |

TOTAL | 29 | 1 | 30 |

Classifying Process (See the UST-AMV College of Accountancy Student Handbook)

First Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

ACC 5111 | Auditing and Assurance Principles | 3 | 0 | 3 | CA 51016 |

ACC 5112 | Auditing and Assurance Principles: Concepts and Applications 1 | 3 | 0 | 3 | CA 51016 |

CA 51015 | Business Tax | 3 | 0 | 3 | CA 5109 |

CA 51020 | International Business and Trade | 3 | 0 | 3 | CA 5108 |

CA 51021 | Financial Markets | 3 | 0 | 3 | CA 51012 |

CA 51022 | Governance, Business Ethics, Risk Management, and Internal Control | 3 | 0 | 3 | CA 51011, ETHICS, THY 4 |

CA 51023 | Accounting Research Methods | 3 | 0 | 3 | CA 51016, CA 51018 |

CA 51024 | Accounting for Business Combinations | 3 | 0 | 3 | CA 51016, CA 5106 |

CA 51025 | Regulatory Framework and Legal Issues in Business | 3 | 0 | 3 | CA 51011 |

CA 51030 | Intermediate Accounting 4 | 3 | 0 | 3 | CA 51016 |

TOTAL | 30 | 0 | 30 |

Second Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

ACC 5113 | Accounting Internship | 0 | 6 | 6 | ACC 5111, ACC 5112 |

ACC 5114 | Accounting Research | 3 | 0 | 3 | ACC 5111, CA 51023 |

ACC 5115 | Intermediate Financial Reporting | 3 | 0 | 3 | CA 51030 |

TOTAL | 6 | 6 | 12 |

First Term

Abbreviation |

Description |

Lec. Hrs. |

Lab. Hrs. |

Units |

Pre-Requisites |

ACC 5116 |

Accounting for Special Transactions |

3 |

0 |

3 |

CA 51015 |

ACC 5117 |

Auditing and Assurance: Concepts and Applications 2 |

3 |

0 |

3 |

ACC 5111, ACC 5112 |

ACC 5118 |

Auditing and Assurance: Specialized Industries |

3 |

0 |

3 |

ACC 5111, ACC 5112 |

ACC 5119 |

Auditing in a CIS Environment |

3 |

0 |

3 |

ACC 5111, CA 51019 |

CA 51026 |

Strategic Management |

3 |

0 |

3 |

CA 51022 |

CA 51027 |

Accounting for Government and Non-Profit Organizations |

3 |

0 |

3 |

CA 51030 |

CA 51028 |

Strategic Business Analysis |

3 |

0 |

3 |

CA 51022 |

ELE 1 |

Professional Elective 1 |

3 |

0 |

3 |

CA 51016, CA 51017, CA 51018, CA 51019 |

ELE 2 |

Professional Elective 2 |

3 |

0 |

3 |

CA 51016, CA 51017, CA 51018, CA 51019 |

ELE 3 |

Professional Elective 3 |

3 |

0 |

3 |

CA 51016, CA 51017, CA 51018, CA 51019 |

TOTAL |

30 |

0 |

30 |

Second Term

Abbreviation |

Description |

Lec. Hrs. |

Lab. Hrs. |

Units |

Pre-Requisites |

ACC 51110 |

Integrated Review in Financial Accounting and Reporting |

6 |

0 |

6 |

ACC 5115 |

ACC 51111 |

Integrated Review in Special Topics Financial Accounting and Reporting |

3 |

0 |

3 |

ACC 5116, CA 51024, CA 51027 |

ACC 51112 |

Integrated Review in Strategic Cost and Financial Management |

3 |

0 |

3 |

CA 51014, CA 51021 |

ACC 51113 |

Integrated Review in Auditing and Assurance |

3 |

0 |

3 |

ACC 5117, ACC 5118, ACC 5119 |

ACC 51114 |

Integrated Review in Business Law and Regulatory Framework |

3 |

0 |

3 |

CA 51017, CA 51025 |

ACC 51115 |

Integrated Review in Taxation |

3 |

0 |

3 |

CA 51015 |

ELE 4 |

Professional Elective 4 |

3 |

0 |

3 |

CA 51016, CA 51017, CA 51018, CA 51019 |

TOTAL |

24 |

0 |

24 |

Effectivity: A.Y. 2019-2020

This curriculum may have some changes upon the availability of new guidelines.

Year | First Term (August – December) | Second Term (January – May) | Special Term (June – July) |

1 | / | / | none |

2 | / | / | none |

3 | / | / | none |

4 | / | / | none |

UST | CHEd | |

General Education | 36 | 36 |

Theology | 12 | – |

NSTP | 6 | 6 |

PE | 8 | 8 |

Common Business and Management Courses | 6 | 6 |

Core Accounting Education Courses | 85 | 81 |

Cognates / Major / Professional Courses | 60 | 36 |

TOTAL | 213 | 173 |

First Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

CA 5101 | Financial Accounting and Reporting | 6 | 0 | 6 | |

CA 5102 | Managerial Economics | 3 | 0 | 3 | |

CA 5103 | Management Science | 3 | 0 | 3 | |

FIL 1 | Kontektuwalisadong Komunikasyon sa Filipino | 3 | 0 | 3 | |

MATH_MW | Mathematics in the Modern World | 3 | 0 | 3 | |

NSTP 1 | National Service Training Program 1 | 0 | 3 | 3 | |

PATH-FIT | Physical Activities Towards Health and Fitness in Dance | 2 | 0 | 2 | |

READ_PH | Readings in Philippine History | 3 | 0 | 3 | |

THY 1 | Christian Vision of the Human Person | 3 | 0 | 3 | |

UND_SELF | Understanding the Self | 3 | 0 | 3 | |

TOTAL | 29 | 3 | 32 |

Second Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

CA 5104 | Operations Management and Total Quality Management | 3 | 0 | 3 | CA 5103 |

CA 5105 | Intermediate Accounting 1 | 3 | 0 | 3 | CA 5101 |

CA 5106 | Conceptual Framework and Accounting Standards | 3 | 0 | 3 | CA 5101 |

CA 5107 | Cost Accounting and Control | 3 | 0 | 3 | CA 5101 |

CA 5108 | Economic Development | 3 | 0 | 3 | |

FIL 2 | Panimulang Pagsasalin | 3 | 0 | 3 | FIL 1 |

NSTP 2 | National Service Training Program 2 | 0 | 3 | 3 | NSTP 1 |

PATH-FIT | Human Enhancement | 2 | 0 | 2 | |

PURPCOM | Purposive Communication | 3 | 0 | 3 | |

STS | Science, Technology, and Society | 3 | 0 | 3 | |

THY 2 | Christian Vision of Marriage and Family | 3 | 0 | 3 | THY 1 |

TOTAL | 29 | 3 | 32 |

First Term

Abbreviation |

Description |

Lec. Hrs. |

Lab. Hrs. |

Units |

Pre-Requisites |

ART_APP |

Art Appreciation |

3 |

0 |

3 |

|

CA 5109 |

Income Taxation |

3 |

0 |

3 |

CA 5101 |

CA 51010 |

Intermediate Accounting 2 |

3 |

0 |

3 |

CA 5101 |

CA 51011 |

Law on Obligations and Contracts |

3 |

0 |

3 |

|

CA 51012 |

Financial Management |

3 |

0 |

3 |

CA 5106 |

CA 51013 |

Information Technology Applications Tools in Business |

3 |

0 |

3 |

CA 5101, CA 5103 |

CA 51014 |

Strategic Cost Management |

3 |

0 |

3 |

CA 5107 |

ETHICS |

Ethics |

3 |

0 |

3 |

|

PATH-FIT |

Physical Activities Towards Health and Fitness in Sports |

2 |

0 |

2 |

|

THY 3 |

Christian Vision of the Church in the Society |

3 |

0 |

3 |

THY 1, THY 2 |

TOTAL |

29 |

0 |

29 |

Second Term

Abbreviation |

Description |

Lec. Hrs. |

Lab. Hrs. |

Units |

Pre-Requisites |

CA 51015 |

Business Taxation |

3 |

0 |

3 |

CA 5109 |

CA 51016 |

Intermediate Accounting 3 |

3 |

0 |

3 |

CA 51010 |

CA 51017 |

Business Laws and Regulations |

3 |

0 |

3 |

CA 51011 |

CA 51018 |

Statistical Analysis with Software Application |

3 |

0 |

3 |

CA 51013 |

CA 51019 |

Accounting Information System |

3 |

1 |

4 |

CA 51013 |

CONTEM_W |

The Contemporary World |

3 |

0 |

3 |

|

LIT 1 |

The Great Works |

3 |

0 |

3 |

|

LIWORIZ |

Life and Works of Rizal |

3 |

0 |

3 |

|

PATH-FIT |

Fitness Exercises for Specific Sports |

2 |

0 |

2 |

|

THY 4 |

Living the Christian Vision in the Contemporary World |

3 |

0 |

3 |

THY 1, THY 2, THY 3 |

TOTAL |

29 |

1 |

30 |

Classifying Process (See the UST-AMV College of Accountancy Student Handbook)

First Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

ACC 5111 | Auditing and Assurance Principles | 3 | 0 | 3 | CA 51016 |

ACC 5112 | Auditing and Assurance Principles: Concepts and Applications 1 | 3 | 0 | 3 | CA 51016 |

CA 51020 | International Business and Trade | 3 | 0 | 3 | CA 5108 |

CA 51021 | Financial Markets | 3 | 0 | 3 | CA 51012 |

CA 51022 | Governance, Business Ethics, Risk Management, and Internal Control | 3 | 0 | 3 | CA 51011, ETHICS, THY 4 |

CA 51023 | Accounting Research Methods | 3 | 0 | 3 | CA 51016, CA 51018 |

CA 51024 | Accounting for Business Combinations | 3 | 0 | 3 | CA 51016, CA 5106 |

CA 51025 | Regulatory Framework and Legal Issues in Business | 3 | 0 | 3 | CA 51011 |

ELE 1 | Professional Elective 1 | 3 | 0 | 3 | CA 51016, CA 51017, CA 51018, CA 51019 |

TOTAL | 27 | 0 | 27 |

Second Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

ACC 5113 | Accounting Internship | 0 | 6 | 6 | ACC 5111, ACC 5112 |

ACC 5114 | Accounting Research | 3 | 0 | 3 | ACC 5111, CA 51023 |

ACC 5115 | Intermediate Financial Reporting | 3 | 0 | 3 | CA 51016 |

TOTAL | 6 | 6 | 12 |

First Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

ACC 5116 | Accounting for Special Transactions | 3 | 0 | 3 | CA 51015 |

ACC 5117 | Auditing and Assurance: Concepts and Applications 2 | 3 | 0 | 3 | ACC 5111, ACC 5112 |

ACC 5118 | Auditing and Assurance: Specialized Industries | 3 | 0 | 3 | ACC 5111, ACC 5112 |

ACC 5119 | Auditing in a CIS Environment | 3 | 0 | 3 | ACC 5111, CA 51019 |

CA 51026 | Strategic Management | 3 | 0 | 3 | CA 51022 |

CA 51027 | Accounting for Government and Non-Profit Organizations | 3 | 0 | 3 | CA 51016 |

CA 51028 | Strategic Business Analysis | 3 | 0 | 3 | CA 51022 |

ELE 2 | Professional Elective 2 | 3 | 0 | 3 | CA 51016, CA 51017, CA 51018, CA 51019 |

ELE 3 | Professional Elective 3 | 3 | 0 | 3 | CA 51016, CA 51017, CA 51018, CA 51019 |

TOTAL | 27 | 0 | 27 |

Second Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

ACC 51110 | Integrated Review in Financial Accounting and Reporting | 6 | 0 | 6 | ACC 5115 |

ACC 51111 | Integrated Review in Special Topics Financial Accounting and Reporting | 3 | 0 | 3 | ACC 5116, CA 51024, CA 51027 |

ACC 51112 | Integrated Review in Strategic Cost and Financial Management | 3 | 0 | 3 | CA 51014, CA 51021 |

ACC 51113 | Integrated Review in Auditing and Assurance | 3 | 0 | 3 | ACC 5117, ACC 5118, ACC 5119 |

ACC 51114 | Integrated Review in Business Law and Regulatory Framework | 3 | 0 | 3 | CA 51017, CA 51025 |

ACC 51115 | Integrated Review in Taxation | 3 | 0 | 3 | CA 51015 |

ELE 4 | Professional Elective 4 | 3 | 0 | 3 | CA 51016, CA 51017, CA 51018, CA 51019 |

TOTAL | 24 | 0 | 24 |

Effectivity: A.Y. 2018-2019

This curriculum may have some changes upon the availability of new guidelines.

Year | First Term (August – December) | Second Term (January – May) | Special Term (June – July) |

1 | / | / | none |

2 | / | / | none |

3 | / | / | none |

4 | / | / | none |

UST | CHEd | |

General Education | 36 | 36 |

Theology | 12 | – |

NSTP | 6 | 6 |

PE | 8 | 8 |

Common Business and Management Courses | 6 | 6 |

Core Accounting Education Courses | 85 | 81 |

Cognates / Major / Professional Courses | 60 | 36 |

TOTAL | 213 | 173 |

First Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

CA 5101 | Financial Accounting and Reporting | 6 | 0 | 6 | |

CA 5102 | Managerial Economics | 3 | 0 | 3 | |

CA 5103 | Management Science | 3 | 0 | 3 | |

FIL 1 | Kontektuwalisadong Komunikasyon sa Filipino | 3 | 0 | 3 | |

MATH_MW | Mathematics in the Modern World | 3 | 0 | 3 | |

NSTP 1 | National Service Training Program 1 | 0 | 3 | 3 | |

PATH-FIT | Physical Activities Towards Health and Fitness in Dance | 2 | 0 | 2 | |

READ_PH | Readings in Philippine History | 3 | 0 | 3 | |

THY 1 | Christian Vision of the Human Person | 3 | 0 | 3 | |

UND_SELF | Understanding the Self | 3 | 0 | 3 | |

TOTAL | 29 | 3 | 32 |

Second Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

CA 5104 | Operations Management and Total Quality Management | 3 | 0 | 3 | CA 5103 |

CA 5105 | Intermediate Accounting 1 | 3 | 0 | 3 | CA 5101 |

CA 5106 | Conceptual Framework and Accounting Standards | 3 | 0 | 3 | CA 5101 |

CA 5107 | Cost Accounting and Control | 3 | 0 | 3 | CA 5101 |

CA 5108 | Economic Development | 3 | 0 | 3 | |

FIL 2 | Panimulang Pagsasalin | 3 | 0 | 3 | FIL 1 |

NSTP 2 | National Service Training Program 2 | 0 | 3 | 3 | NSTP 1 |

PATH-FIT | Human Enhancement | 2 | 0 | 2 | |

PURPCOM | Purposive Communication | 3 | 0 | 3 | |

STS | Science, Technology, and Society | 3 | 0 | 3 | |

THY 2 | Christian Vision of Marriage and Family | 3 | 0 | 3 | THY 1 |

TOTAL | 29 | 3 | 32 |

First Term

Abbreviation |

Description |

Lec. Hrs. |

Lab. Hrs. |

Units |

Pre-Requisites |

ART_APP |

Art Appreciation |

3 |

0 |

3 |

|

CA 5109 |

Income Taxation |

3 |

0 |

3 |

CA 5101 |

CA 51010 |

Intermediate Accounting 2 |

3 |

0 |

3 |

CA 5101 |

CA 51011 |

Law on Obligations and Contracts |

3 |

0 |

3 |

|

CA 51012 |

Financial Management |

3 |

0 |

3 |

CA 5106 |

CA 51013 |

Information Technology Applications Tools in Business |

3 |

0 |

3 |

CA 5101, CA 5103 |

CA 51014 |

Strategic Cost Management |

3 |

0 |

3 |

CA 5107 |

ETHICS |

Ethics |

3 |

0 |

3 |

|

PATH-FIT |

Physical Activities Towards Health and Fitness in Sports |

2 |

0 |

2 |

|

THY 3 |

Christian Vision of the Church in the Society |

3 |

0 |

3 |

THY 1, THY 2 |

TOTAL |

29 |

0 |

29 |

Second Term

Abbreviation |

Description |

Lec. Hrs. |

Lab. Hrs. |

Units |

Pre-Requisites |

CA 51015 |

Business Taxation |

3 |

0 |

3 |

CA 5109 |

CA 51016 |

Intermediate Accounting 3 |

3 |

0 |

3 |

CA 51010 |

CA 51017 |

Business Laws and Regulations |

3 |

0 |

3 |

CA 51011 |

CA 51018 |

Statistical Analysis with Software Application |

3 |

0 |

3 |

CA 51013 |

CA 51019 |

Accounting Information System |

3 |

1 |

4 |

CA 51013 |

CONTEM_W |

The Contemporary World |

3 |

0 |

3 |

|

LIT 1 |

The Great Works |

3 |

0 |

3 |

|

LIWORIZ |

Life and Works of Rizal |

3 |

0 |

3 |

|

PATH-FIT |

Fitness Exercises for Specific Sports |

2 |

0 |

2 |

|

THY 4 |

Living the Christian Vision in the Contemporary World |

3 |

0 |

3 |

THY 1, THY 2, THY 3 |

TOTAL |

29 |

1 |

30 |

Classifying Process (See the UST-AMV College of Accountancy Student Handbook)

First Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

ACC 5111 | Auditing and Assurance Principles | 3 | 0 | 3 | CA 51016 |

ACC 5112 | Auditing and Assurance Principles: Concepts and Applications 1 | 3 | 0 | 3 | CA 51016 |

CA 51020 | International Business and Trade | 3 | 0 | 3 | CA 5108 |

CA 51021 | Financial Markets | 3 | 0 | 3 | CA 51012 |

CA 51022 | Governance, Business Ethics, Risk Management, and Internal Control | 3 | 0 | 3 | CA 51011, ETHICS, THY 4 |

CA 51023 | Accounting Research Methods | 3 | 0 | 3 | CA 51016, CA 51018 |

CA 51024 | Accounting for Business Combinations | 3 | 0 | 3 | CA 51016, CA 5106 |

CA 51025 | Regulatory Framework and Legal Issues in Business | 3 | 0 | 3 | CA 51011 |

ELE 1 | Professional Elective 1 | 3 | 0 | 3 | CA 51016, CA 51017, CA 51018, CA 51019 |

TOTAL | 27 | 0 | 27 |

Second Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

ACC 5113 | Accounting Internship | 0 | 6 | 6 | ACC 5111, ACC 5112 |

ACC 5114 | Accounting Research | 3 | 0 | 3 | ACC 5111, CA 51023 |

ACC 5115 | Intermediate Financial Reporting | 3 | 0 | 3 | CA 51016 |

TOTAL | 6 | 6 | 12 |

First Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

ACC 5116 | Accounting for Special Transactions | 3 | 0 | 3 | CA 51015 |

ACC 5117 | Auditing and Assurance: Concepts and Applications 2 | 3 | 0 | 3 | ACC 5111, ACC 5112 |

ACC 5118 | Auditing and Assurance: Specialized Industries | 3 | 0 | 3 | ACC 5111, ACC 5112 |

ACC 5119 | Auditing in a CIS Environment | 3 | 0 | 3 | ACC 5111, CA 51019 |

CA 51026 | Strategic Management | 3 | 0 | 3 | CA 51022 |

CA 51027 | Accounting for Government and Non-Profit Organizations | 3 | 0 | 3 | CA 51016 |

CA 51028 | Strategic Business Analysis | 3 | 0 | 3 | CA 51022 |

ELE 2 | Professional Elective 2 | 3 | 0 | 3 | CA 51016, CA 51017, CA 51018, CA 51019 |

ELE 3 | Professional Elective 3 | 3 | 0 | 3 | CA 51016, CA 51017, CA 51018, CA 51019 |

TOTAL | 27 | 0 | 27 |

Second Term

Abbreviation | Description | Lec. Hrs. | Lab. Hrs. | Units | Pre-Requisites |

ACC 51110 | Integrated Review in Financial Accounting and Reporting | 6 | 0 | 6 | ACC 5115 |

ACC 51111 | Integrated Review in Special Topics Financial Accounting and Reporting | 3 | 0 | 3 | ACC 5116, CA 51024, CA 51027 |

ACC 51112 | Integrated Review in Strategic Cost and Financial Management | 3 | 0 | 3 | CA 51014, CA 51021 |

ACC 51113 | Integrated Review in Auditing and Assurance | 3 | 0 | 3 | ACC 5117, ACC 5118, ACC 5119 |

ACC 51114 | Integrated Review in Business Law and Regulatory Framework | 3 | 0 | 3 | CA 51017, CA 51025 |

ACC 51115 | Integrated Review in Taxation | 3 | 0 | 3 | CA 51015 |

ELE 4 | Professional Elective 4 | 3 | 0 | 3 | CA 51016, CA 51017, CA 51018, CA 51019 |

TOTAL | 24 | 0 | 24 |

While all programs are anchored on core accounting, business, and general education courses, each program offers a course of study unique and relevant to each accounting specialization.

The BS Accountancy (BSA) program offers a wide array of courses on external financial statements assurance and audit services. BSA graduates are expected to take the licensure examination for certified public accountants administered by the Board of Accountancy (Philippines) and other international accounting certifications (e.g., ACCA).

Meanwhile, the BS Management Accounting (BSMA) program is focused on corporate accounting and controllership. BSMA graduates are expected to take the Certified Management Accountant (CMA) examination administered by the Institute of Management Accountants (USA and Australia), or the Certified Institute of Management Accountants (CIMA).

Finally, the BS Accounting Information System (BSAIS) program is geared towards a career in information systems audit and information technology governance with a foundation on accounting information systems. BSAIS graduates are expected to take the Certified Information Systems Auditor (CISA) examination administered by ISACA (USA), the international professional organization of information technology governance professionals.

With the breadth and depth offered by the specialized and general courses respectively, graduates of the UST AMV College of Accountancy are expected to become lifelong learners and leaders regardless of specialization.

As a rule, the University has a debarment policy applicable to students who incur failures corresponding to 9 units or the equivalent of one-half of their load (for students who did not take the full regular load).

However, freshmen in their first term in the University are exempted from this rule. A student who in his/her first term in the University and who incurs failures corresponding to nine units or more will be allowed to be readmitted in the succeeding term on a probationary basis.

The probationary basis will allow the student to clear all his/her deficiencies until the succeeding special term. Failure to clear the deficiencies and/or incurring additional deficiencies in the second term will exclude the student on probation from admission to the second curriculum year.

Moreover, any student who incurs a failure during the first curriculum years, subject to the debarment policy as stated, cannot anymore proceed to the BS Accountancy Program and may choose between the BSMA or BSAIS.

The debarment policy of the University will apply as discussed above.

An uncleared deficiency pertains to an instance of failure in a course which is still to be removed through retaking and passing the said course.

For example, if in the first term of his/her first year, a student incurs a failure in a three-unit course then the student’s deficiency is three units at the end of the first term.

If in the succeeding (second) term, the same student retakes the same course and still incurs a failure, his/her deficiency becomes six units. As a rule, uncleared deficiencies are counted by instance and not by course.

A student without failure for the first and second years may choose any one of the three programs, including the BSA, if s/he has a grade of 2.50 or better in all accounting, finance, law, and taxation courses. All other students who did not incur failures but did not meet the 2.50 grade will be ranked based on grades’ weighted average (GWA) and may be considered for the BSA program, subject to availability of slots.

Yes, the student may be retained in the BSA program provided s/he did not incur failures in any of the courses. S/he may also shift to the BSMA or BSAIS programs.

Yes, provided that all classification requirements are met. However, courses in the first and second years across the three programs are common. It is more efficient if the student will wait for the classification process (at the end of the second year) if s/he considers shifting to another program.

Yes, the debarment policy will still apply to all students across all programs. The debarment policy of the University does not allow his/her admission during the subsequent term when the accumulated uncleared deficiency is at least 9 units. Fourth year students, however, are not anymore subject to debarment. For this purpose, fourth year students are those who have successfully completed all the courses in the three curriculum years of the program.

Yes, the debarment policy will still apply to all students across the program, except for fourth-year students. Also for this purpose, fourth year students are those who have successfully completed all the courses in the three curriculum years of the program(s).

Yes, this will be considered as a second-degree application covered by the student handbook (PPS No. 1009a). Furthermore, the 2.50 grade requirement during the first two curriculum years, among others shall still apply.

ASEAN University Network – Quality Assurance Certified

PACUCOA Level III Accreditation

Accredited (BS Accountancy)

The University of Santo Tomas is one of the leading private research universities in the Philippines and is consistently ranked among the top 1000 universities in the whole world. With academic degrees and research thrusts in the natural, health, applied, social, and sacred sciences, as well as business and management, the University continuously strives to make a positive impact on the society.

Visit Us:

Espana Blvd., Sampaloc, Manila, Philippines 1008

© Copyright 2023. University of Santo Tomas. All Rights reserved. | Powered by Communications Bureau